Exness Minimum Deposit

Home » Minimum deposit

Deposit Requirements

Exness provides Malaysian traders flexible deposit options with varying minimum requirements across account types. The platform supports multiple payment methods accepting Malaysian Ringgit (MYR) deposits. Account funding processes maintain security protocols while ensuring efficient transaction processing.

Initial deposits determine account activation and trading capabilities. Malaysian traders can select from various account types with corresponding minimum deposit requirements. Payment processing maintains compliance with local banking regulations and security standards.

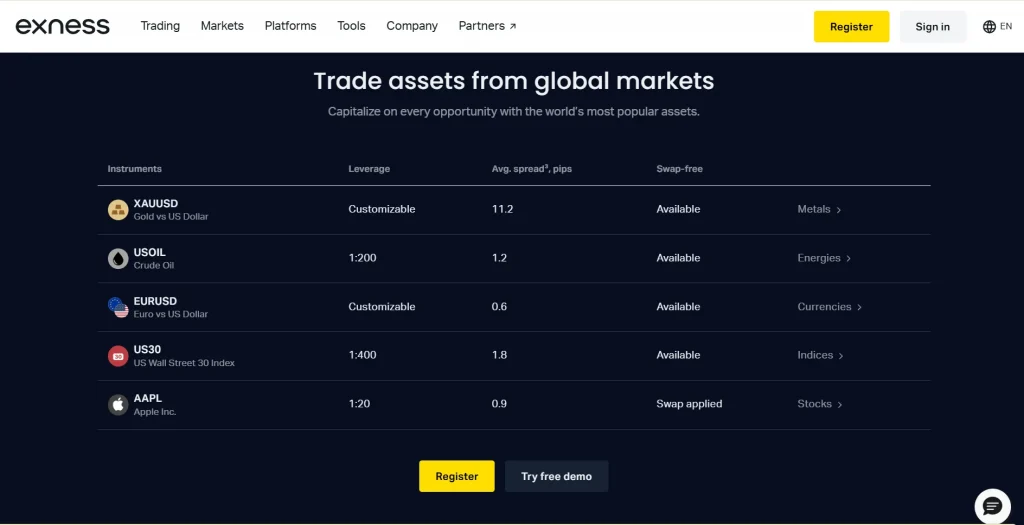

Account Type Requirements

| Account Type | Minimum (MYR) | Processing Time |

| Standard | 4 | Instant |

| Raw Spread | 840 | Instant |

| Zero | 840 | Instant |

| Pro | 840 | Instant |

Payment Methods

Malaysian traders access multiple deposit options supporting local payment systems. Electronic payment methods provide instant processing while bank transfers require standard processing times. Each payment method maintains specific minimum deposit requirements.

Platform systems support major Malaysian banks and electronic payment providers. Transaction processing includes automatic currency conversion where necessary. Security protocols protect all financial transactions through encryption systems.

Available Payment Options

Deposit methods include:

- Local bank transfer

- Credit/debit cards

- E-wallets

- Cryptocurrency

- Mobile payment systems

Processing Times

Different payment methods maintain varying processing schedules. Electronic payments typically process instantly while bank transfers require 1-3 business days. Processing times consider Malaysian banking hours and system requirements.

Transaction confirmation provides immediate notification through registered contact methods. Platform systems track deposit status providing real-time updates. Processing delays receive automatic notification with estimated completion times.

Processing Factors

Timing depends on:

- Payment method

- Banking hours

- System verification

- Security checks

- Amount limits

Currency Conversion

| Original Currency | Target Currency | Conversion Fee |

| MYR | USD | 0% |

| MYR | EUR | 0% |

| MYR | GBP | 0% |

Deposit Verification

Security protocols require verification for certain deposit amounts and methods. Verification procedures follow regulatory requirements protecting transaction integrity. Malaysian traders provide necessary documentation through secure channels.

Platform systems maintain transaction records ensuring compliance and traceability. Verification requirements increase with larger deposit amounts following security protocols. Support services assist with verification procedures through dedicated channels.

Verification Requirements

Documentation includes:

- Payment proof

- Identity verification

- Source of funds

- Address confirmation

- Bank statements

Account Funding Limits

Different account types maintain specific funding limitations. Maximum deposit limits vary by payment method and account status. Platform systems monitor deposit patterns ensuring regulatory compliance.

Limit adjustments require additional verification maintaining security standards. Account status influences available deposit limits and processing requirements. Regular reviews update limit structures according to account activity.

Transaction Security

Security systems protect deposit processes through multiple verification layers. Encryption protocols secure transaction data during processing. Malaysian banking security standards integrate with platform protection systems.

Platform security includes fraud prevention and transaction monitoring. Authentication requirements protect deposit processes preventing unauthorized access. Security protocols adapt to emerging threats maintaining protection levels.

Security Features

Protection includes:

- Data encryption

- Two-factor authentication

- Transaction monitoring

- Fraud detection

- Account verification

Deposit Bonuses

Account funding may qualify for promotional offers following terms and conditions. Bonus qualification requires minimum deposit amounts meeting promotional criteria. Platform systems automatically process qualifying deposits applying relevant bonuses.

Promotion participation requires acceptance of specific terms and conditions. Bonus processing occurs automatically for qualifying deposits. Trading requirements apply to bonus funds following promotional terms.

Failed Transactions

Support services assist with failed deposit resolution through dedicated channels. Transaction recovery procedures follow structured protocols protecting client funds. Platform systems maintain transaction records supporting resolution processes.

Failed transaction resolution includes automatic notification and support contact. Recovery procedures vary by payment method and failure reason. Support services prioritize deposit-related issues ensuring quick resolution.

Frequently Asked Questions

Standard accounts accept minimum deposits from 4 MYR, while professional account types require 840 MYR minimum. Actual minimums may vary by payment method.

Electronic payment methods provide instant processing. Bank transfers typically require 1-3 business days depending on Malaysian banking hours and system requirements.

Yes, the platform accepts MYR deposits through various payment methods. Currency conversion occurs automatically where necessary with no additional fees.