Exness Social Trading

Home » Social Trading

Social Trading Platform Overview

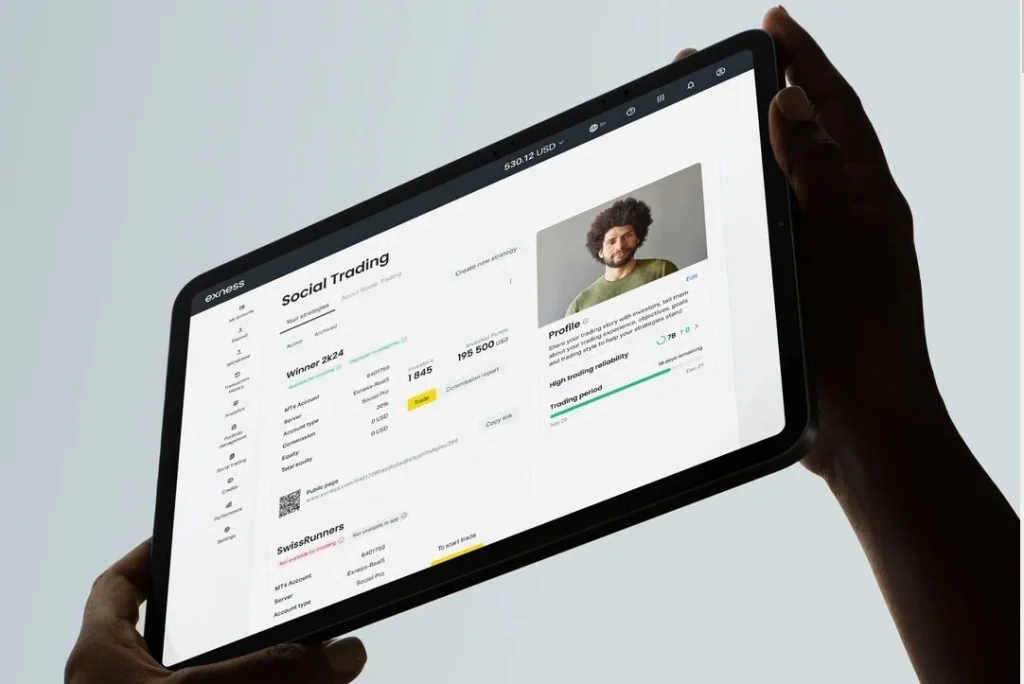

Exness social trading system enables Malaysian traders to connect with global trading communities and copy successful strategies. The platform provides comprehensive performance tracking and strategy analysis tools for informed decision-making. Social trading features integrate seamlessly with existing trading accounts and platforms.

The system maintains transparent performance metrics and risk assessment tools. Malaysian traders can access detailed statistics about strategy providers and their trading history. Platform features support both strategy providers and copying traders through various tools and analytics.

Platform Features

Core functionalities include:

- Strategy copying

- Performance tracking

- Risk management

- Portfolio diversification

- Real-time monitoring

Strategy Provider Selection

| Metric | Description | Importance |

| Track Record | Historical performance | Primary |

| Risk Score | Risk assessment rating | Critical |

| Drawdown | Maximum loss period | Essential |

| Consistency | Performance stability | Key |

Performance Indicators

Key metrics include:

- Profit percentage

- Risk level

- Trading volume

- Success rate

- Consistency score

Copy Trading Process

Copy trading initiation requires account setup and strategy selection. Malaysian traders can allocate specific amounts in MYR for strategy copying. The system automatically replicates selected trader positions according to predetermined settings.

Copy settings allow customization of position sizing and risk parameters. Platform tools enable multiple strategy copying with portfolio management features. Real-time monitoring ensures immediate response to strategy changes.

Copy Settings Configuration

Settings include:

- Investment amount

- Risk limitation

- Position sizing

- Instrument selection

- Stop-loss levels

Risk Management Tools

Social trading includes comprehensive risk management features protecting copying traders. Position monitoring tools track strategy performance and risk levels. Automated protection mechanisms prevent excessive losses through predetermined limits.

Risk assessment systems evaluate strategy provider performance and market conditions. Platform features enable quick strategy adjustment or termination based on performance metrics.

Portfolio Management

| Strategy Type | Minimum (MYR) | Maximum (MYR) |

| Conservative | 420 | 42,000 |

| Moderate | 840 | 84,000 |

| Aggressive | 2,100 | 210,000 |

Management Features

Available tools include:

- Asset allocation

- Risk distribution

- Performance tracking

- Strategy rotation

- Profit monitoring

Strategy Provider Requirements

Strategy providers meet specific performance and documentation requirements. Provider status requires maintained trading history and performance metrics. Malaysian traders can become strategy providers meeting qualification criteria.

Provider monitoring ensures continued compliance with platform standards. Performance evaluation includes regular assessment of trading patterns and risk levels.

Performance Analytics

Analytics tools provide detailed performance assessment capabilities. Statistical analysis includes various timeframes and market conditions. Performance metrics support informed strategy selection and monitoring.

Platform analytics integrate multiple data sources providing comprehensive performance overview. Real-time analysis enables quick response to changing market conditions.

Analysis Tools

Available analytics:

- Performance graphs

- Risk assessment

- Correlation analysis

- Market impact

- Strategy comparison

Communication Features

Platform includes communication tools connecting traders and strategy providers. Message systems enable direct communication maintaining privacy standards. Information sharing follows regulatory compliance requirements.

Community features support knowledge sharing and strategy discussion. Platform moderation ensures appropriate communication standards and information quality.

Community Interaction

Features include:

- Direct messaging

- Strategy comments

- Performance reviews

- Market discussion

- Trading insights

Account Integration

Social trading integrates with existing Exness trading accounts. Platform systems synchronize account data enabling seamless strategy copying. Malaysian traders maintain full control over account settings and permissions.

Integration features support multiple account types and trading platforms. System compatibility ensures consistent performance across different trading environments.

Profit Distribution

Profit calculation considers investment amount and strategy performance. Distribution systems process earnings according to platform guidelines. Malaysian traders receive profits in local currency through standard withdrawal methods.

Performance fees apply according to strategy provider agreements. Transparent fee structures ensure clear understanding of cost implications.

Frequently Asked Questions

Minimum investment starts from 420 MYR, varying by strategy type and provider requirements. Different strategies may require higher minimums based on risk levels.

Yes, copy settings can be adjusted anytime, including investment amount, risk parameters, and position sizing. Changes take effect on new positions only.

Strategy copying can be terminated instantly through platform controls. Open positions can be closed immediately or managed according to user preferences.